Press Releases

Atlanta, GA—October 4—A new first party research study conducted in collaboration between Splitit and PYMNTS has provided strong evidence supporting the demand for card-linked installment plans. This insightful research confirms the broad appeal among shoppers from diverse demographic backgrounds when it comes to using their bank-issued credit cards for deferred payment options. The findings clearly contrast with the prevailing narrative promoted by Buy Now, Pay Later (BNPL) lenders who load up consumers with high fees and high interest rates while demonizing credit cards.

More than half of all Gen Z and Millennial shoppers intend to increase their use of installment plans for their holiday shopping, according to a new study by Splitit and PYMNTS Intelligence, Installment Plans Becoming a Key Part of Shoppers’ Toolkit. The first party survey also found that consumers across a broad spectrum of generations and income levels use interest-free installment plans. In fact, 64% of consumers earning more than $100,000 annually favor installment plans, challenging assumptions about credit usage and income. The study also found that nearly one-third of all shoppers would consider purchasing a higher priced item if they could pay for it using interest-free installments linked to their own existing credit card.

“As we move into the critical holiday shopping season, it’s imperative for retailers to pay as much attention to their checkout experience as they do to their merchandise selection,” said Nandan Sheth, Chief Executive Officer, Splitit. “Interestingly, our study showed that high-earners would utilize installments more if they were attached to their favorite bank issued credit card, without the need to apply for a new loan. Retailers will miss out on sales if they do not capitalize on the evolving consumer behavior to expand their market reach.”

Consumer sentiment now favors installment plans from traditional credit card issuers over those from legacy Buy Now, Pay Later (BNPL) providers or store-based programs. In the past year, 45% of consumers have chosen these plans compared to 37% for BNPL and store-issued installments. Furthermore, 42% of credit card installment plan users were high income earners. In fact, high-earning Millennial shoppers were found to be most likely to use credit card installment plans.

The study further revealed that nearly one-in-three shoppers would consider purchasing a higher priced item if they could pay for it in interest-free installments linked to their own existing credit card. Furthermore,

Other key findings include:

- High earning millennial shoppers are the consumers most likely to use a credit-card based interest-free installment plan, because they value credit card rewards.

- A staggering 60% of all shoppers used some type of installment payment option over the past twelve months. While Millennials as a generation lead the usage of installment plans at 72%, the study found that even older consumers used them to pay for consumer goods over the past twelve months. 62% percent of Generation X and 46% of installment-averse Baby Boomers and Seniors used them. This data points to a seismic shift in consumer spending habits and a newfound zest for flexible payment solutions.

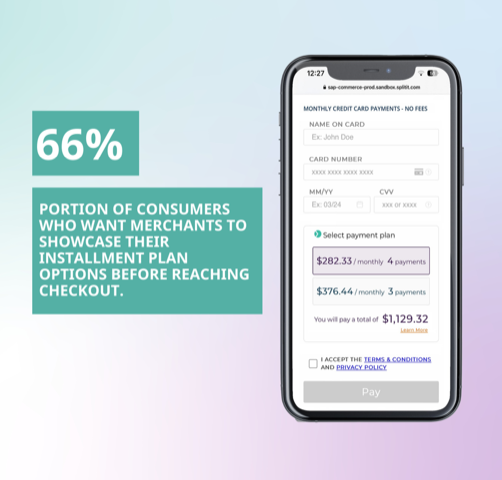

- Two-thirds of consumers prefer merchants to inform them of the availability of installment plans before they get to the checkout. Making shoppers aware of installment plans at checkout is too late as they have already decided what they want to buy and how much they want to spend.

- Financial flexibility and convenience are the key drivers for installment plan adoption, with 74% of respondents saying they use them to better spend management. Over 75% of general-purpose credit card installment plans users cited this factor as the primary reason for paying in installments.

- Trust is an important factor, with 37% of respondents placing their faith and finances with providers they deemed reputable. Also, 27% of consumers using credit card installment plans did so to earn rewards.

- Clothing and Accessories saw the greatest penetration of installment payments usage at almost 40%. Yet other high-ticket categories such as Home Furnishings and Appliances (nearly 30% each), Auto Parts (nearly 21%), and Building Materials and Garden Supplies (nearly 16%), were also popular categories for installment payments.

- Nearly 57% of consumers who did not use installment plans said that they did not need to finance purchases, while 37% were concerned with overspending. Interestingly, almost 13% didn’t use them because they received no rewards, and 7.4% were concerned with data privacy.

- Over 40% of Millennials who choose installment plans do so to improve their credit scores in contrast to just 33% of Gen Z who do the same.

About Splitit

Splitit is a global payment solution provider that lets shoppers use the credit they’ve earned by breaking up purchases into monthly interest-free installments using their existing credit card. Splitit enables merchants to improve conversion rates and increase average order value by giving customers an easy and fast way to pay for purchases over time without originating new credit. Splitit serves many of Internet Retailer’s top 500 merchants and is accepted by more than 1,500 eCommerce merchants in over 30 countries and shoppers in over 100 countries. Headquartered in Atlanta, Splitit has an R&D centre in Israel and offices in London and Australia. The Company is listed on the Australian Securities Exchange (ASX) under ticker code SPT. The Company also trades on the US OTCQX under ticker codes SPTTY (ADRs) and STTTF (ordinary shares).

Methodology

Installment Plans Becoming a Key Part of Shoppers’ Toolkits was produced in partnership with Splitit and PYMNTS Intelligence. It is based on a survey of 2,572 consumers, fielded from August 8 – 12, 2023. The sample was census-based with respect to the U.S. population, with 51% of respondents identifying as female and 34% holding a college degree. The average age was 47, and 39% earned more than $100,000 annually.

Splitit Media Contact:

Berns Communications Group

Danielle Poggi / Michael McMullan

dpoggi@bcg-pr.com / mmcmullan@bcg-pr.com

Stay Up-To-Date with Our Latest News and Information.